FAQ

FAQFlareLiquidStaking

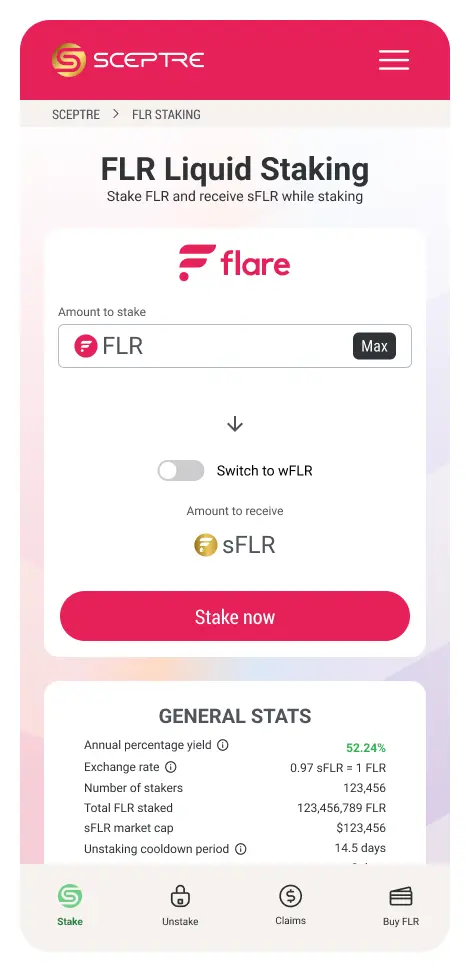

A better way to maintain rewards on your FLR/wFLR while also being able to access the equity for other activities.

0 FLR$0

Amount of FLR staked

0

Number of stakers

Benefits of staking FLR/wFLR with Sceptre- Flare Drops increase the value of sFLR vs wFLR/FLR

- 14.5 days unlock period

- No need to periodically claim rewards

- Seamlessly stake and start earning

- Gain additional utility on your interest bearing asset to be freely utilized within Decentralized Finance (DeFi).